Many business leaders I talk to still regard ESG an additional burden that requires investment and stands in the way of running their business profitably. How wrong. Andrew Winston in “The Big Pivot” writes: “We must pivot – sometimes painfully, always purposefully – so that solving the world’s biggest challenges profitably becomes the core pursuit of business.” The following sources underpin his message.

ESG creates value

From our experience and research, ESG links to cash flow in five important ways: (1) facilitating top-line

growth, (2) reducing costs, (3) minimizing regulatory and legal interventions, (4) increasing employee productivity, and (5) optimizing investment and capital expenditures. Each of these five levers should be part of a leader’s mental checklist when approaching ESG opportunities

Source: McKinsey. Five Ways that ESG Creates Value. Nov 2019. https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Strategy%20and%20Corporate%20Finance/Our%20Insights/Five%20ways%20that%20ESG%20creates%20value/Five-ways-that-ESG-creates-value.ashx

Sustainability can make good business sense

“Corporate Sustainability at a Crossroads: Progress Toward Our Common Future in Uncertain Times,” by the MIT Sloan Management Review and The Boston Consulting Group was published in May 2017. Here are three findings from its eight-year corporate sustainability research effort based on survey responses from more than 60,000 business practitioners at global companies and more than 150 thought-leader interviews:

-

Companies that focus on material issues reported up to 50% added profit from sustainability activities, compared to those that do not.

-

Building sustainability into business units can double an organization’s chance of profiting from its sustainability activities.

-

90% of executives surveyed believe sustainability is important. However, 60% of companies have a sustainability strategy and only 25% have developed a clear business case for their sustainability efforts.

Source: A Business Case Your CFO will Love. https://www.corporateecoforum.com/business-case-cfo-will-love/

More people choose sustainable

Consumer attitudes are also shifting: demand for sustainable products and services is on the rise. According to a recent BCG analysis, 72% of consumers in Europe prefer products in environmentally friendly packaging, and 46% of consumers worldwide say that they would choose ecofriendly products over a preferred brand. In the consumer packaged goods industry, for example, a recent survey by the Corporate Eco Forum found that sustainable products were responsible for 50% of market growth from 2013 to 2018 and accounted for a dollar market share of 16.6% during that period.

Source: BCG. Unlocking Tomorrow’s ESG Opportunities. April 2020. https://www.bcg.com/publications/2020/future-esg-environmental-social-governance-opportunities

Globally, 85 percent of people indicate that they have shifted their purchase behavior towards being more sustainable in the past five years — however, we observe meaningful generational differences in attitude. When looking at both Baby Boomers and Generation X, 24 percent across each have significantly changed their behavior towards being more sustainable — this figure climbs to 32 percent for Millennials. Additionally, one third of Millennials will choose a sustainable alternative when available, whereas older generations are less likely to actively choose sustainable alternatives (24-29 percent).

Source: Recent Study Reveals More Than a Third of Global Consumers Are Willing to Pay More for Sustainability as Demand Grows for Environmentally-Friendly Alternatives. Oct 2021. https://www.businesswire.com/news/home/20211014005090/en/Recent-Study-Reveals-More-Than-a-Third-of-Global-Consumers-Are-Willing-to-Pay-More-for-Sustainability-as-Demand-Grows-for-Environmentally-Friendly-Alternatives

ESG drives financial markets cunami

Morningstar evaluated short-term, annual performance over the last three years. In 2015–17, managers who considered sustainability in their investment process outperformed their Morningstar category by 57 percent, 55 percent, and 54 percent, respectively.

Morningstar also evaluated longer-term performance of these same funds. Morningstar assigns a 1–5 star rating based on long-term performance. As of the end of 2017, 40 percent of the sustainable funds had 4 or 5 stars, while only 24.5 percent had 1 or 2 stars (the mutual fund universe had 32.5 percent of funds in the top two categories combined).

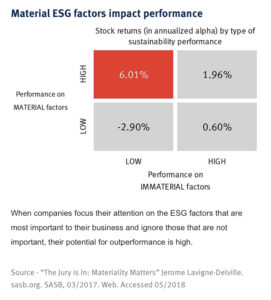

Prioritize materiality for performance

Source: RBC Asset Management. Beyond the bottom line: The ESG investing advantage. https://www.rbcwealthmanagement.com/gb/en/research-insights/beyond-the-bottom-line-the-esg-investing-advantage/detail/

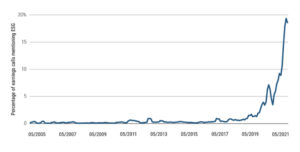

Pimco, which oversees $2.2 trillion in assets, analyzed earnings call transcripts of about 10,000 global companies between May 2005 and May 2021. From May 2005 to May 2018, environmental, social and governance (ESG) mentions hovered between 0% to 1% of calls. By 2019, mentions rose to 5%, and by May 2021, it was 19%.

ESG mentions in earnings calls

Source: Mentions of ‘ESG’ and sustainability are being made on thousands of corporate earnings calls. July 2021. https://www.marketwatch.com/story/mentions-of-esg-and-sustainability-are-being-made-on-thousands-of-corporate-earnings-calls-11626712848

From January through November 2020, investors in mutual funds and ETFs invested $288 billion globally in sustainable assets, a 96% increase over the whole of 2019. I believe that this is the beginning of a long but rapidly accelerating transition – one that will unfold over many years and reshape asset prices of every type. We know that climate risk is investment risk. But we also believe the climate transition presents a historic investment opportunity.

Source: Larry Fink’s annual letter to CEOs. Blackrock. 2021. https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

If companies do not take ESG factors into consideration as part of their business strategy, they may find themselves exposed to risks such as reputational damage and poor financial performance. However, when properly integrated into the business strategy, ESG factors can be turned into business opportunities.

One example of a potential environmental risk is waste management. If managed improperly, waste management could have a negative impact on a company. Globally, a third of all food is wasted, which is detrimental to the environment. For supermarkets, throwing away food that has passed its expiry date it is costly and it could also damage the supermarket’s reputation with the public. To tackle this issue, several Nordic supermarkets are working to minimise waste by reducing the price of food that is near its expiry date or by using this food in their cafeterias.

Source: Sustainable lending. Danske Bank. https://danskebank.com/sustainability/sustainable-finance/sustainable-lending